Follow Your Hart Home

Central Ohio Housing Report - February 2024

CLOSINGS, NEW LISTINGS, AND MEDIAN SALES PRICES SHOWED SIGNIFICANT GAINS OVER 2023

The housing market in central Ohio is heating up according to the latest sales numbers recorded in the Columbus & Central Ohio Regional Multiple Listing Service (MLS) for February.

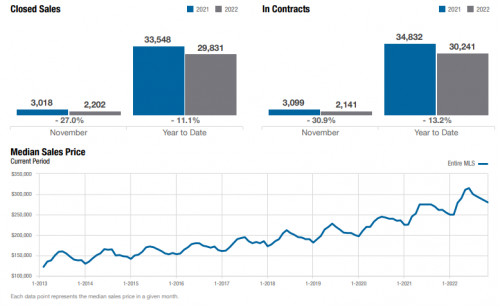

Closed sales spiked 10.8 percent year over year, and total inventory increased 21.7 percent compared with February 2023. The total inventory of homes for sale is 2,817 residences, which equates to a 1.2-month supply of inventory.

“This is the second consecutive month that we have recorded an increase in closed sales after about a year and a half of decline when comparing year-over-year,” said Columbus REALTORS® President Scott Hrabcak.

“I’m encouraged by the number of closed sales, but I am most excited by the nearly 22 percent increase in inventory. Our consumers need choices, and our REALTOR® members are ready to work hard for their clients. There is a tremendous demand in central Ohio, and it is shaping up to be a competitive spring in our region.”

“While we have shown some positive trends in inventory, we have a long way to go. Central Ohio remains firmly a seller’s market, so buyers and sellers should be prepared to act quickly to navigate this dynamic landscape.”

Sparking the rise in inventory was 2,357 total new listings, an 18 percent uptick over February 2023. Of the new listings, Westerville City School District saw 80 new homes hit the market for an 18 percent increase. There were 55 new listings in Worthington City School District, resulting in a 53 percent uptick. Delaware City Schools was another standout area with 62 new listings, which was a 77 percent increase year-over-year.

The median sales price in central Ohio increased 6.9 percent to $299,300 this month, and homes sold for just 0.9 percent under asking price.

Columbus REALTORS® is composed of almost 10,000 real estate professionals engaged in residential and commercial sales and leasing, property management, appraisal, consultation, real estate syndication, land development, and more.

The Columbus REALTORS® Multiple Listing Service (MLS) serves all of Franklin, Delaware, Fayette, Licking, Madison, Marion, Morrow, Pickaway, and Union Counties and parts of Athens, Champaign, Clark, Clinton, Fairfield, Hocking, Knox, Logan, Muskingum, Perry, and Ross counties.

To view residential properties for sale, visit realtor.com

To view commercial properties for sale or lease, visit crexi.com

For media inquiries, please contact Craig Hicks, Senior Director of Communication & Engagement